Investor

Considerations In

Emerging Real

Estate Markets

Investment Considerations

Several considerations we have identified for making successful investments in international markets

RISKS

Supply isn’t keeping

up with demand

Currency

exchange rates

Lack of local knowledge

Different legal and regulatory systems

Limited Liquidity

and Lending

MITIGATIONS

Target growing cities with population influxes. Focus on markets with

high barriers to new construction. Build new developments to help fill

supply gap

Use currency hedges to mitigate exchange rate risk Invest in countries with stable/rising currencies. Maintain locally-denominated mortgages to match revenue when possible

Members spending time in jurisdiction. Hire local experts for insight into

markets. Partner with domestic firms familiar with area. Start with more

stable/transparent markets

Research laws and get legal counsel in each market. Focus initial

investments in countries with clear property rights

Seek non-bank capital sources like equity investment, private

lending or partnerships. Provide higher levels of equity to

offset lower leverage options

Investment Strategy

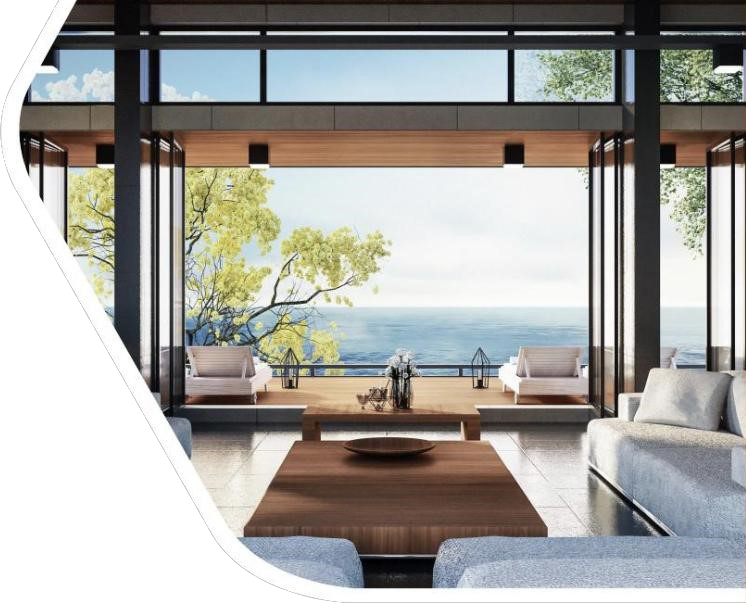

Globally, the rental market needs 7M short- and medium-term housing. The US alone needs 3M additional long term rentals within next 5 years. Today, only 4M new housing are planned to built in 5 years.

To help meet this growing demand, Breakthrough Investments will build or acquire at least 10 properties over the next 5 years in emerging domestic and international markets. Our rental properties will cater to vacationers, business travelers, digital nomads, snowbirds, and expats who desire luxury or moderate accommodations

Investment Highlights

Luxury Hotels Residence Investment Program: Our fund offers luxury affordable real estate on branded hotel premises or close by. This amplify demand, 20 to 30% higher rates and reduce risk of unproven and unsafe locations.

Hold Long Term: Real estate is a relatively stable investment, as it is not as volatile as other asset classes such as stocks or bonds.

Potential for High Returns: Global real estate has the potential to generate high returns, especially in emerging markets.

Tax Benefits: Real estate investments can offer a variety of tax benefits, such as depreciation deductions & capital gains tax breaks.

Diversification: Construct diversified portfolio of 10-15 properties across minimum 5 countries which helps to mitigate risk. These areas are politically stable, developing infrastructure and friendly to western investors

Investment Criteria

Deal Attributes

-

New development or value-add opportunities. Residences with amenities required by customer profile

New development or value-add opportunities. Residences with amenities required by customer profile

< 5 hours Fight from Their Port of oOrigin

-

If travelers are from North America, we will have locations for them. If port of origin is Europe, Africa, Middle East, we have luxury stay.

If travelers are from North America, we will have locations for them. If port of origin is Europe, Africa, Middle East, we have luxury stay.

Target Returns

-

Seek IRR of 12-14% Target cash yields of 6-8% Goal of 1.3-1.8X equity multiple on exit Source: Airdna rental platform

Seek IRR of 12-14% Target cash yields of 6-8% Goal of 1.3-1.8X equity multiple on exit Source: Airdna rental platform

Operational Metrics

-

Short term target occupancy above 53% with RevPAR greater than $250. Long term rentals with occupancy above 80% with $1,700-$3,500 per month

Short term target occupancy above 53% with RevPAR greater than $250. Long term rentals with occupancy above 80% with $1,700-$3,500 per month

Diversification

-

Construct portfolio across minimum 5 countries . Target politically stable emerging markets

Construct portfolio across minimum 5 countries . Target politically stable emerging markets

English Law

-

We are targeting countries whose legal system are base on US or British common law

We are targeting countries whose legal system are base on US or British common law

Investor Friendly Incentives

-

Foreign investor ownership Landlord friendly. Retirees and foreign business incentives

Foreign investor ownership Landlord friendly. Retirees and foreign business incentives

Due Diligence

-

Full legal review Third-party valuations Physical & operational due diligenceCustomer profile i.e., luxury and standard

Full legal review Third-party valuations Physical & operational due diligenceCustomer profile i.e., luxury and standard